- Startup vs Acquisition – Which is Best? - August 21, 2023

- How to Get Money to Start a Business - August 7, 2023

- How to Raise Capital to Start a Business - February 17, 2023

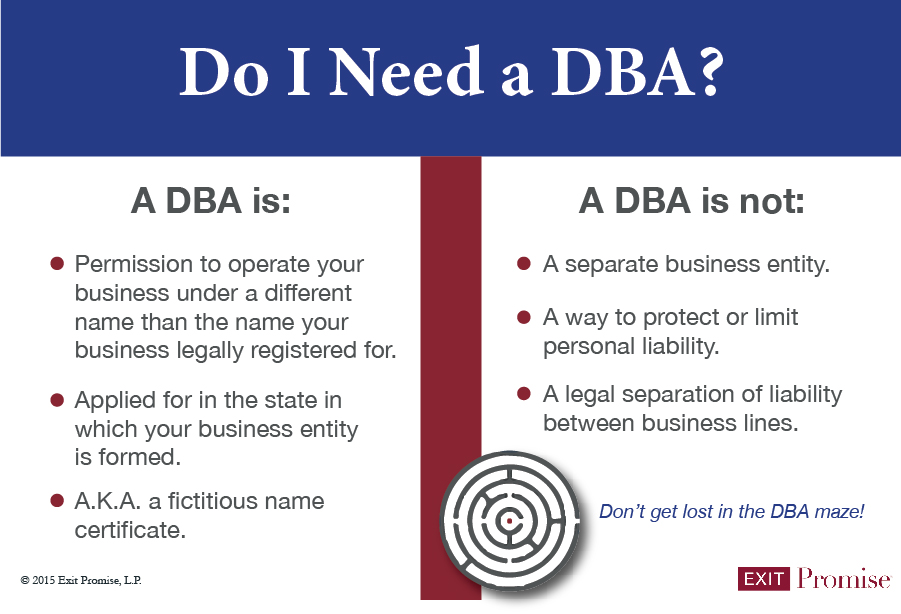

In part 2 of this series, we discussed how to incorporate multiple businesses under a single “umbrella” LLC, Corporation or Partnership by filing multiple DBAs or fictitious business names. Many people often have questions about filing a DBA registration to create a fictitious business name. And many just simply ask, what is a DBA?

The DBA is often misunderstood, but it can be a valuable way to promote your business and gain some protections of your rights as a business owner. However, you need to make sure you know exactly what a DBA is and is not as well as the limitations of a DBA so you may protect your intellectual property and trademark rights.

Many small business owners believe a DBA is actually a separate business entity. It is not!

Do you have a question? Ask at the bottom of this post.

One of our advisors will answer!

What is a DBA?

A DBA is merely an application made to the state in which you request permission to utilize a different name than the name your business legally registered for and obtained. Think of a DBA certificate as a permission slip granted by the state for to you call your business (or a line of your existing business) a different name.

A DBA is not a separate business entity. And more importantly, it does not offer the small business owner any liability protection whatsoever!

A DBA really is the acronym for “doing business as” and it represents a fictitious name certificate for you (if you are a sole proprietorship) or your business entity.

Why File for a DBA?

There are many reasons why a business owner may choose to file for a DBA or fictitious name certificate after they have started a business. Many times, they simply don’t like the original name chosen or it doesn’t align with the brand image for marketing purposes.

Many business owners also believe if they add multiple businesses to their original business, that they should file a DBA certificate for each new business. While this may be necessary and desirable, it’s very important to understand that there is no legal separation of liability between each of these businesses with separate DBA certificates! Should something go wrong with one of the operations marketing under a DBA and held under a single business entity, all lines of business may be in jeopardy!

DBA Examples

The lack of legal separation with a DBA is an important point, so let’s walk through an example:

Jonathan starts a restaurant called Jonathan’s Barbecue, Inc. We’ll keep it simple and assume that he doesn’t own the building or property. Instead, he is simply renting space. After operating for several years, many of his customers suggest he begin to do catering. He hires a marketing company who designs a new logo for his catering business. Jonathan is up and running, however the name differs from his restaurant Jonathan’s Barbecue, Inc. Jonathan chooses to file for a DBA for the new line of business “Jonathan’s Catering.”

In this case, if at some point in the future a terrible accident occurs while delivering the catering services under the Jonathan’s Catering line of business, all of the assets owned by Jonathan’s Barbecue, Inc., as well as its income, would be in jeopardy. The reason for this is the DBA “Jonathan’s Catering” is merely another asset owned by Jonathan’s Barbecue, Inc.

If Jonathan wanted to separate the liabilities (the risks) in the two lines of business (his Barbecue, Inc. restaurant and catering), he should consider forming another business entity (an LLC, corporation or partnership) for the catering business

What are the Benefits of Registering a DBA for your business?

- Compliance: Filing or registering a DBA allows you to legally use a business name without incorporating as an LLC or corporation.

- Business banking: Filing a DBA enables you to get a business bank account in the name of your business and take payments in the name of your business, even if you haven’t formed an LLC.

- Flexibility: DBAs are easy and affordable to file, so they offer great flexibility to suit the needs of your expanding, evolving business. For example, if Jane Doe Cookbooks, LLC launches a new website, they can file a DBA for “JaneDoeCookbooks.com” which would keep that site’s business activities covered under the umbrella protection of the original LLC. If Jane Doe Cookbooks, LLC starts offering private chef services, online cooking classes, or starts selling cooking supplies, they could easily file DBAs for each of these new ventures under the same overall LLC.

What are the limitations of filing or registering a DBA?

- Filing a DBA is not the same as trademark protection: If you file a DBA, you have the right to use a business name, but you don’t have the right to prevent anyone else from using that same business name. If you want a higher level of protection, you need to register a federal trademark.

- Lack of tax benefits: A DBA is not a corporation, so merely filing a DBA that is not part of a “corporate umbrella” like an LLC will not give you any special tax benefits. If you are “only” doing business as a DBA, any money your business makes passes through to your individual tax return and is taxed accordingly. If you want to get the tax benefits that go with having a corporate structure, you would need to form an LLC and file taxes as an S-Corporation (or other corporate entity, which has different tax treatment). Be sure to consult with your attorney and/or professional tax adviser before you make a final decision on a choice of business entity structure.

Filing a DBA can be a fast and effective option to make your business “official” while providing certain benefits, but be sure you are aware of the limitations of this business name designation.

As with so many other business decisions, the fastest, cheapest solution is not always the best. But filing a DBA can be helpful for structuring multiple businesses as long as they are all integrated under an overall LLC or other corporate umbrella.

About how much does a DBA cost?

Hi Tedrick,

The state in which you file for a fictitious name (DBA) will charge a fee and it’s typically not more than a few hundred dollars.

You may also need to publish in your local legal journal the DBA notification when it’s officially awarded for a nominal cost.

All the best…

I already have a LLC working as an independent contractor as a nanny. That’s my current income. On the other hand, I would like to start a new side business as my own travel agency – nothing related to my current job. I was thinking about opening a DBA under my LLC for this new business – considering it is something new and won’t be making money for at least a couple of years, I don’t see it being worth it to open a whole new LLC for it. The question is: Am I allowed to have a DBA under my current LLC even though it wouldn’t be in the same field as my LLC? So basically two different business but under the same one. If so, can I still write off expenses from both under the LLC name and EIN? If not, what would be my best option? I am scared of paying way too many taxes with two LLC considering I already pay a lot since I don’t have a lot to deduct as a nanny. Thank you so much!

Hi Camila,

Yes, your current LLC may file for another fictitious name (DBA) for your intended new travel agency business.

And yes, you may deduct any expenses related to each business under the same LLC/EIN.

All the best…

Under a dba I would receive $10k for a job. I buy $9500 for supplies and pay for helpers my taxable income is $500. Correct or false?

Hi John,

It sounds to me that as an individual, you’ve filed a fictitious name (or DBA).

If so, then you are a sole proprietor and for income tax purposes, if you were paid for a project and after paying for supplies and any contractors or employees, you have $500 left, that would be your net profit.

The income and expenses should be reported on a Schedule C if you are a sole proprietor.

Hope that helps!

Already have an S-Corp in good standing for the last 7+ years in professional medical billing service. Last year – same S-Corp decided to start another line of business ‘professional medical tax reporting/filing services” – obtained a DBA name in 2023. Now how do we file IRS and State Taxes – where to report DBA expenses/profits/losses on S-Corp or should we file DBA taxes separately… I don’t know if it will allow to use same EIN.

Hi Sri Raj,

If the S Corp filed for the DBA for the new line of business, then all of the income and expenses related to the DBA should be reported on your S Corp’s tax return. This is the case for both the federal and state tax return filings.

Think of the DBA operation as a separate department in the S Corp. The taxing authorities view it as all the same business.

Hope this helps!

Hi I have a DBA and an llc im doing business in pa so let me get this right if I work under my DBA with the ein give to me it’ll go on my personal taxes and using the name I’m not really protected as like an llc?

Hi Kevin,

I believe you’ve established and LLC and have filed a fictitious name (DBA) for yourself as well. You’ve got two business operations — one that’s a separate, legal business entity (the LLC) and another that’s a sole proprietorship (the DBA). If I’ve got that right, then…

Any work (income) you earn in the sole proprietorship (DBA), will be reported on your personal income tax return on Schedule C. That DBA may have its own EIN if you (individually) applied for one. The fictitious name (DBA) would be reported on the Schedule C.

You have no legal protections whatsoever when you operate a business as a sole proprietor, even if you file for a fictitious name (DBA) and apply for an EIN. None. You are the business operating under a fictitious name and reporting your income and expenses under an EIN.

The LLC does offer business owners certain and more legal protection.

Does this make sense to you Kevin?

How much does it cost DBA

Hi Penny,

Each state (or county, city) established its own fee schedule for filing a fictitious name (DBA), so it depends on where your business is registered.

All the best…

I have an LLC in the state of Maryland. Currently I operate under a DBA. I am considering changing the name of the Dba or would it be easier to simply add a second Dba? Additionally, is my current Dba under the llc insured so that I cannot be personally sued?

Hi Rachel,

You’ve asked a few questions…

Let’s start with the last one — no matter what you do or don’t do, you can always be sued personally. The lawsuit may not have any merit, but there is nothing to stop someone from suing you.

I assume you have a Maryland LLC that has file for a fictitious name (DBA).

If that’s the case and you want the LLC to have a different fictitious name, just terminate the DBA your LLC currently has and file for the new DBA you desire.

All the best…

Hello, thanks for your time. Two questions:

1. I’m partnering with a friend (two of us 50/50) for a new business based in FL. We recognize that our idea has a lot of growth potential and could eventually add different types of income avenues within the same industry. Because of this, we thought we should register the company as an LLC under the name “ABC Group”. Then do a DBA for our first brand “XYZ”. Then add more DBAs as we grow and add more businesses. We also plan to trademark/copyright each DBA. Is this the right way to do it?

2. In addition, as an entrepreneur, I have many business ideas popping into my head. I currently have two businesses that are ready to go. One is a consulting business and the other is an ecommerce (unrelated). I was debating if I should register each of these separately as individual LLCs or if I can do some sort of umbrella under my ownership. Is there a way to put multiple LLCs under one umbrella?

Thanks for any feedback you can provide.

Hi Sky,

To address your first question — the answer really depends on whether you want one single business (whatever entity you choose) to own ALL of the assets and share ALL of the liabilities related to ALL of thee businesses you intend to start.

Be careful. Using a DBA is not a separate business entity. It’s a brand.

As for your second question — Yes, you may be able to form a Series LLC to accomplish what you have described. We’ve got a post that covers this topic here.

All the best…